There are so many forex robot programs out there, it has become very difficult to decide which one is a real good performer and which one is going to take your bank account with it. In this article, I have tried to list the traits of a good forex robot vs. a bad one.

Smoothness of the balance curve

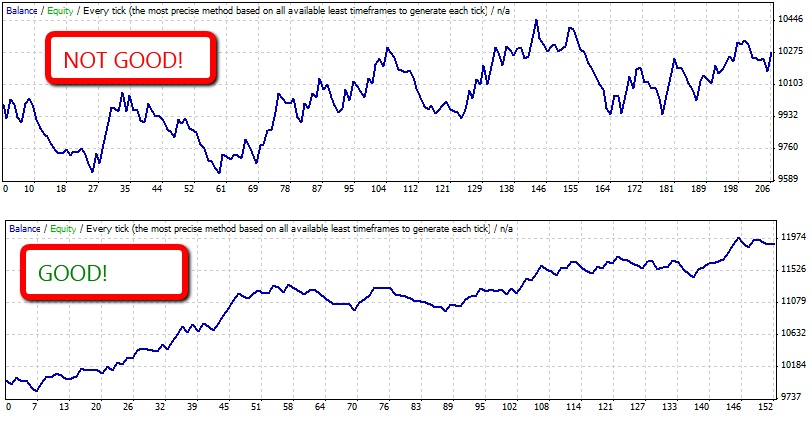

It is impossible to find a robot that will give 100% success. However, the robot that gives more winning trades than losing trades and that also, individual losses are not very big is a good one. A smooth curve is something that looks like the one shown below:

Number of test transactions

You should look at how many test transactions the robot back-test has created. Any robot program can show short-term gain but the good ones show gain over a longer period. Longer period usually means more orders. This way, you can be certain that the robot has been tested over a significant period of time and has proven to make money in various market conditions. I usually do not publish a robot on my site if there are less than 500 test orders during the back-testing.

High frequency of order creation

You want to see a robot that creates orders frequently enough. What is the point in running a robot that creates 2 orders over the entire year? That kind of robot will be very hard to test and validate as you will have to run it over a really long period to get some critical test results mass. I typically go for robots that are creating at least 2-3 orders a weak.

Maximum drawdown

A DRAWDOWN is a percentage of an account which could be lost in the case when there is a streak of losing trades. It is a measure of the largest loss that a trader’s account can expect to have at any given moment or period of time. You want a robot that has maximum drawdown less than your tolerance limit. For example, if you have an account that is 1000 USD balance and you do not want to lose money more than 10% of the account balance at any given time, you want to make sure the maximum drawdown of the robot you want to use is less than 100 USD. This can be controlled using lot sizes also but in general you do not want a robot that has significant drawdowns.

Equity curve above balance curve

If you are going for a forex robot that opens multiple trades, look for the equity curve in comparison to the balance curve. Good robots will have equity line above the balance line for most of the period. This indicates that the robot is opening trades that are mostly turning profitable quickly and stay profitable for a long time. You want to avoid robots that have equity line below balance line. This means, robot is mostly opening losing trades.

Average size of trades

A good robot would have its entry and exit strategies such that the average size of winning trades is similar to average size of losing trades. This is important because when this happens, you don’t need to have very high winning ratio. I call such robots “balanced” robots. You should stay away from robots where average winning trades are significantly smaller than average losing trades. Those are very risky as it takes only few losing trades to potentially wipe out your account.